Metaplanet's Bitcoin Bonanza - A Strategic Play

Metaplanet's Aggressive Bitcoin Acquisition

A Bold Move in the Cryptocurrency Space

Metaplanet, a Japanese investment firm, is making waves in the cryptocurrency world with its ambitious plan to accumulate as much Bitcoin as possible. This move is a significant shift in the company's strategy, aligning with the footsteps of MicroStrategy, a pioneer in corporate Bitcoin adoption.

Securing Funds for Bitcoin Acquisition

Metaplanet has recently secured a substantial loan of ¥1 billion (approximately $7.3 million USD) to purchase additional Bitcoin. This funding will enable the company to aggressively expand its Bitcoin holdings, demonstrating its commitment to this new corporate objective.

A Strategic Play in the Cryptocurrency Market

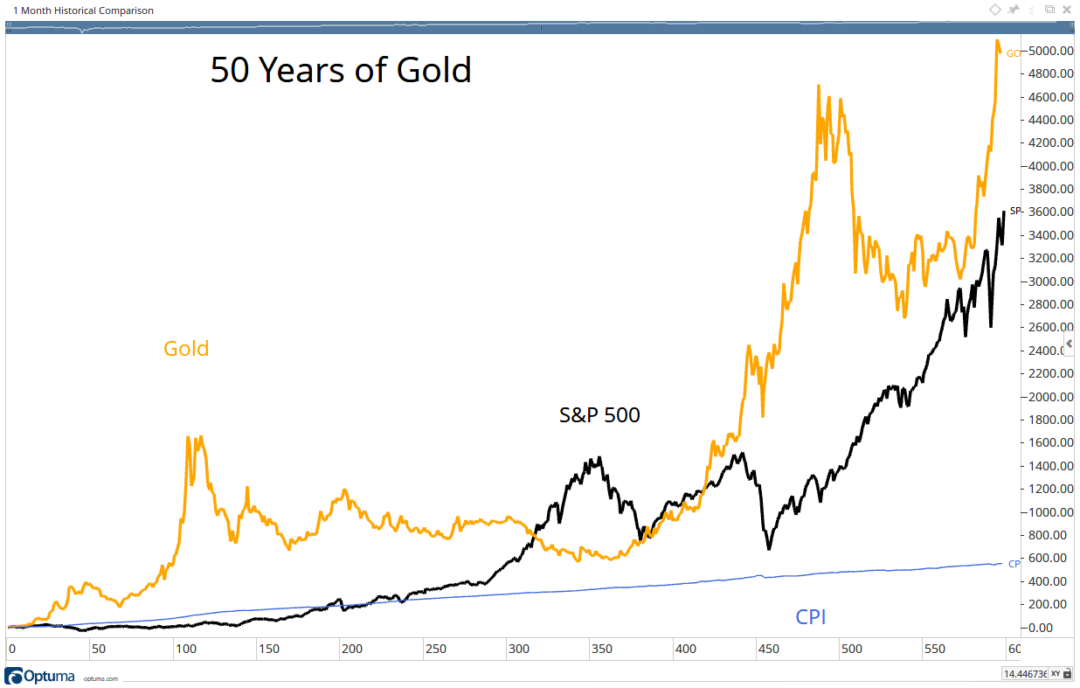

Metaplanet's decision to accumulate Bitcoin is a strategic move, positioning the company for potential long-term growth and returns. By following in the footsteps of MicroStrategy, Metaplanet is embracing the potential of Bitcoin as a store of value and a hedge against inflation.

A Strategic Play to Hedge Against Economic Uncertainty

Metaplanet's recent foray into Bitcoin acquisition is a calculated move to mitigate economic uncertainty, specifically Japan's staggering debt burden and yen volatility. This strategic play is rooted in the company's belief that accumulating Bitcoin is the most valuable action they can take for their shareholders.

Japan's Debt Burden: A Ticking Time Bomb

Japan's national debt has been a longstanding concern, with a staggering debt-to-GDP ratio that surpasses 250%. This enormous burden threatens economic stability, making it imperative for companies like Metaplanet to explore alternative stores of value.

Yen Volatility: A Threat to Economic Growth

The Japanese yen's fluctuating value poses a significant risk to businesses operating within the country. Metaplanet's Bitcoin acquisition serves as a hedge against yen volatility, ensuring the company's assets are protected from sudden currency devaluations.

Bitcoin: A Store of Value and a Hedge

Bitcoin's decentralized nature, limited supply, and growing adoption make it an attractive asset for companies seeking to diversify their holdings. By accumulating Bitcoin, Metaplanet is not only hedging against economic uncertainty but also positioning itself for potential long-term growth.

A Prudent Move for Shareholders

Metaplanet's strategic play demonstrates a commitment to protecting and growing shareholder value. By diversifying their assets and hedging against economic uncertainty, the company is taking a proactive approach to navigating Japan's complex economic landscape.

A Makeover as Japan's MicroStrategy

Metaplanet, a pioneering force in the cryptocurrency landscape, has undergone a remarkable transformation, earning the esteemed title of "Japan's MicroStrategy" within the crypto community. This moniker is a testament to the company's strategic embrace of Bitcoin accumulation, mirroring the successful playbook of MicroStrategy, a global leader in enterprise software and Bitcoin adoption.

Soaring Stock Performance

Since adopting MicroStrategy's Bitcoin accumulation strategy, Metaplanet's stock has experienced a staggering surge, multiplying by seven times. This exponential growth underscores the effectiveness of the company's bold move, resonating with investors and cementing its position as a trailblazer in the cryptocurrency space.

A New Identity: "Japan's MicroStrategy"

Crypto Twitter has enthusiastically dubbed Metaplanet as "Japan's MicroStrategy," acknowledging the company's unwavering commitment to Bitcoin accumulation. This nickname not only reflects Metaplanet's strategic alignment with MicroStrategy's pioneering approach but also highlights its emergence as a leading force in Japan's cryptocurrency market.

Strategic Playbook

Metaplanet's success can be attributed to its astute adoption of MicroStrategy's proven Bitcoin accumulation strategy, which involves:

- Regular Bitcoin purchases, regardless of market fluctuations

- Long-term holding and storage in secure wallets

- Strategic allocation of assets to maximize returns

By embracing this strategic playbook, Metaplanet has positioned itself for sustained growth, navigating the complexities of the cryptocurrency market with confidence and expertise.

A Beacon for Institutional Adoption

Metaplanet's transformation serves as a compelling example for institutional investors and companies considering Bitcoin adoption. As "Japan's MicroStrategy," Metaplanet demonstrates the potential for significant returns and strategic growth through calculated cryptocurrency investments.

A New Era for Metaplanet

Metaplanet's new corporate objective marks a significant shift in the company's strategy, signaling a bold new direction that is poised to revolutionize the way we think about digital assets. This seismic shift is centered around one core focus: accumulating Bitcoin.

A Strategic Play for the Ages

By making Bitcoin accumulation its primary objective, Metaplanet is effectively positioning itself as a makeshift Bitcoin ETF for Japanese investors. This move has far-reaching implications, not only for the company but also for the broader cryptocurrency market.

A Bitcoin Bonanza for Investors

This strategic play offers a unique opportunity for Japanese investors to gain exposure to the coveted digital asset, providing a gateway to the vast potential of the Bitcoin market. As Metaplanet continues to accumulate Bitcoin, investors can reap the benefits of this bold new strategy.

A New Frontier for Metaplanet

This significant shift in strategy heralds a new era for Metaplanet, one marked by innovation, growth, and a commitment to pushing the boundaries of what is possible in the digital asset space. As the company embarks on this exciting new chapter, one thing is clear: the future of Metaplanet has never looked brighter.

Comments ()