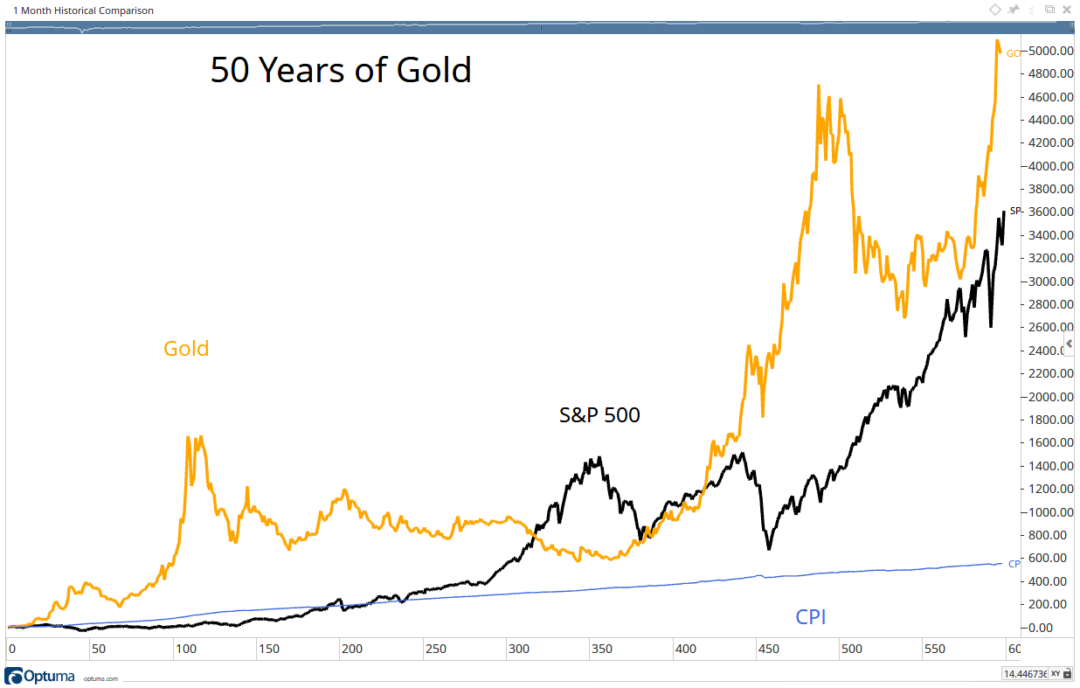

Gold vs. Stocks in 2024 - Navigating a Turbulent Market

The age-old debate of gold versus stocks continues to rage on in 2024. With global economic uncertainty lingering, investors are seeking refuge in assets that offer both stability and potential for growth. This article dives into the performance of gold and stocks in recent months, providing insights to guide your investment decisions in the current market.

Gold's Steady Climb Amidst Volatility

Gold, traditionally viewed as a safe-haven asset, has lived up to its reputation in the early months of 2024. As of February 2024, gold prices have surged past the $2,000 per ounce mark, propelled by several factors:

- Inflationary Pressures: Despite efforts by central banks to tame inflation, it remains stubbornly high. Gold, with its intrinsic value, acts as a hedge against inflation, preserving purchasing power during uncertain economic times.

- Geopolitical Tensions: Ongoing geopolitical conflicts and rising global tensions contribute to market volatility. Investors often flock to gold during such periods, seeking a safe haven from the turmoil.

- Weakening Dollar: The value of the US dollar, the currency in which gold is priced, has weakened against other major currencies. A weaker dollar makes gold more attractive to international investors, further driving up demand.

Stock Market Fluctuations: A Bumpy Ride

In contrast to gold's steady ascent, the stock market has experienced a more turbulent journey in early 2024. While major indices like the S&P 500 and Nasdaq initially showed signs of recovery, they have since faced significant pullbacks due to a confluence of factors:

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation have weighed heavily on stock valuations. Higher borrowing costs impact corporate profits and investor sentiment.

- Recession Fears: Concerns over a potential recession loom large. Economic indicators like slowing GDP growth and consumer spending contribute to this apprehension, making investors wary of riskier assets like stocks.

- Earnings Disappointments: Several high-profile companies have reported disappointing earnings in recent quarters, signaling a potential slowdown in corporate profitability. This has further dampened investor confidence and fueled market volatility.

Navigating the Decision: Factors to Consider

The choice between gold and stocks is highly personal and depends on individual investment goals, risk tolerance, and time horizon. Consider these factors when making your decision:

1. Investment Goals and Time Horizon

If you're investing for the long term (10 years or more) and prioritize capital appreciation, stocks have historically outperformed gold. However, if you seek short-term gains or aim to preserve capital during economic uncertainty, gold might be a more suitable option.

2. Risk Appetite

Stocks, while offering higher potential returns, also carry significantly more risk than gold. Gold, with its intrinsic value and historical performance as a safe-haven asset, tends to be less volatile, making it a potentially safer bet for risk-averse investors.

3. Portfolio Diversification

Both gold and stocks play a crucial role in a well-diversified portfolio. Including both asset classes can mitigate overall risk. Gold acts as a hedge against inflation and economic downturns, while stocks offer growth potential over the long term.

Concluding Remarks: Finding the Right Balance

In the volatile landscape of 2024, the choice between gold and stocks is complex and multifaceted. There's no one-size-fits-all answer. Carefully assess your individual circumstances, risk tolerance, and investment goals. Consult with a financial advisor if needed to create a balanced portfolio that aligns with your financial aspirations and helps you navigate the current market turbulence successfully.

Comments ()