Food Format Shifts - Trends Reshaping the Industry

Imagine a world where restaurants operate without kitchens, and meal kits are tailored to your DNA – sound like science fiction? Welcome to the future of food. The way we produce, consume, and interact with food is undergoing a seismic shift. With the global online food delivery market projected to reach $154.34 billion by 2025, it's clear that the food industry is ripe for disruption. As we dive into the trends reshaping the industry, one thing is certain – the future of food has never been more exciting or uncertain.

The Evolving Grocery Landscape

You've probably noticed the changes in grocery shopping over the past few years - everything's getting more digital, healthier, and personalized. The global grocery sector's facing some big challenges, though. Inflation's squeezing budgets, automation's changing how stores operate, and consumers are more health-conscious than ever. According to a report by Euromonitor, the global grocery market's expected to grow at a CAGR of 4.5% from 2023 to 2028, but it's not all smooth sailing.

Shifting Consumer Priorities

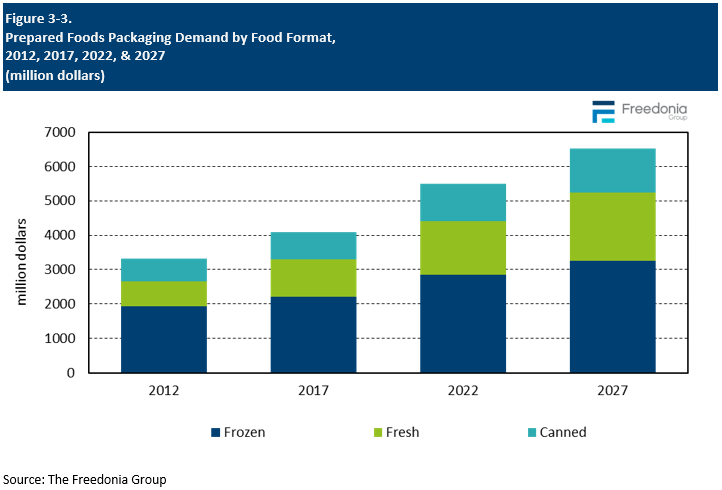

What's driving this evolution? For starters, consumers are seeking fresher, healthier options. Fresh food sales grew by 7.2% in 2023, outpacing overall grocery growth, says NielsenIQ. Supermarkets are responding by expanding their fresh offerings - think gourmet cheese sections, in-store sushi, and pre-prepped meal kits. Private labels are also having a moment, with brands like Tesco's Finest and Sainsbury's Taste the Difference capturing market share.

Omnichannel integration's another biggie - you're probably shopping online more, and stores are investing heavily to make digital shopping seamless. Ocado's reported a 14.5% increase in online sales in 2023, showing how crucial online channels are becoming. Then there's format shifts - compact stores, dark stores for delivery, and experiential formats like pop-ups are reshaping the retail landscape.

- Fresh food focus: healthier, locally-sourced options

- Private label expansion: quality at affordable prices

- Omnichannel integration: blending online and offline

- Format innovation: from dark stores to experiential retail

As Kelsey Joachim, Senior Retail Analyst at Euromonitor, puts it, "Supermarkets need to be agile, adapting to changing consumer behaviors and leveraging data-driven insights to stay competitive." The stakes are high, but so are the opportunities - for stores that get it right, there's a chance to capture loyal customers and drive growth.

Fresh Food Reigns Supreme

Fresh food is still king, and it's shaping the way stores are designed and how they engage with customers. Just look at the likes of Walmart and Metro Cash & Carry, they're revamping their store layouts to prioritize fresh produce and meats, making it easier for you to grab what you need quickly. This shift isn't just about aesthetics; it's driven by data showing customers are willing to pay a premium for freshness.

Reducing Waste, Boosting Profits

So, how are retailers keeping fresh food fresh? Digital shelf-life tracking and hyper-local supply chains are the new norm. Carrefour has implemented these technologies to reduce spoilage and increase turnover. By analyzing sales data and weather forecasts, they can predict demand with surprising accuracy, cutting waste by up to 30%.

Predictive ordering tools are also helping stores like SPAR stay on top of stock levels, ensuring popular items are always available. These tools aren't just about reducing waste; they're about boosting efficiency and profitability too. By optimizing inventory management, retailers can pass the savings on to you, the customer.

- Reduced waste and increased efficiency

- Improved customer satisfaction and loyalty

- Better stock management and availability

Redesigned floorplans are another key part of the equation. By placing fresh food front and center, retailers are creating a more engaging shopping experience. You'll notice grab-and-go sections and ready-to-eat meals becoming more prominent, catering to your increasingly busy lifestyle.

Private Label Goes Premium

You're probably noticing more premium products on store shelves, and it's not just the big brands that are driving the trend. Private labels have come a long way from their low-cost, generic roots. Today, retailers are using their own labels to offer sophisticated, brand-caliber products that can rival national brands. Take Trader Joe's, for example. Their private-label products account for about 80% of their sales, and they're known for their unique and high-quality offerings.

Protecting Margins and Building Loyalty

So, why are retailers going big on private labels? For one, it helps them protect their margins. By selling their own products, retailers can avoid paying hefty fees to national brands and keep more of the profit for themselves. Plus, private labels give retailers the flexibility to innovate and respond quickly to changing consumer trends. And let's not forget about customer loyalty – when you offer unique and delicious private-label products, customers are more likely to stick with your store.

According to a report by Nielsen, premium store brands are growing faster than traditional brands in many markets. In fact, private-label sales have been growing at a rate of 4-5% annually in the US, outpacing the overall food industry. Retailers like Aldi and Lidl have already disrupted the market with their affordable and high-quality private-label products. Now, other retailers are taking notice and following suit.

Case Study: Costco's Kirkland Signature

Costco's Kirkland Signature brand is a great example of private-label success. Launched in 1995, Kirkland Signature offers a wide range of products, from coffee to vitamins to tires. The brand has become synonymous with quality and value, and it's estimated that Kirkland Signature products account for around 20% of Costco's sales. That's a serious loyalty-driving machine.

As retailers continue to invest in their private-label offerings, you can expect to see even more innovation and premium products on store shelves. It's a win-win for both retailers and consumers – and a challenge for traditional brands to keep up.

Omnichannel Becomes the Norm

Grocery shopping's changed big time, hasn't it? You're now browsing online, checking prices, reading reviews, and maybe even buying in-store. Or maybe you're doing it the other way around – browsing in-store, scanning a QR code, and getting the best deal online. The lines are blurring, and customers are loving it.

Retailers are taking notice. Big players like Reliance Retail and Tata Starbucks are working hard to deliver seamless experiences across channels. They're syncing promotions, centralising inventory, and making sure you're getting the same deal whether you're online or offline. It's not just about convenience; it's about building trust. And let's be honest, who doesn't love a good deal?

The Tech Behind the Magic

To keep up, retailers are having to revamp their tech stacks. We're talking real-time inventory updates, cross-channel fulfilment, and all the jazz. Companies like Flipkart are investing big in this space, making sure their systems can handle the fluidity of modern shopping. It's not cheap, but it's necessary. Customers expect it, and retailers are having to adapt.

- Real-time inventory updates reduce stockouts and overstocking

- Cross-channel fulfilment gives customers more options

- Centralised inventory management makes life easier for retailers

It's a big shift, but one that's paying off. Customers are happier, retailers are seeing more sales, and the industry's evolving. What's next? Maybe we'll see more AI-powered recommendations or AR shopping experiences. The future's looking bright.

Store Formats Adapt to Purpose

You've probably noticed that supermarkets aren't what they used to be. Traditional layouts are making way for speed-focused and engagement-driven designs. Take Tesco's 'Express' format, for instance, which dedicates more space to fresh produce, ready-to-eat meals, and coffee areas – perfect for busy professionals grabbing a quick lunch.

Location-Specific Strategies

Chains are getting clever about testing formats based on postcode, income bracket, and shopping patterns. In India, Reliance Retail's Fresh stores are a great example – they've tailored their layouts to cater to local tastes and preferences. They're experimenting with formats that prioritize fresh produce, dairy, and household essentials, keeping customers engaged with interactive displays and cooking demos.

Micro-format stores are also on the rise, designed for specific needs like workday meals, refill items, and health-specific purchases. Think of Amazon Fresh's compact stores or Lidl's 'no-frills' format, which cater to customers looking for quick, hassle-free shopping experiences.

- Workday meals: Spencers Bistro in corporate hubs, offering grab-and-go meals and snacks

- Refill items: Bulk stores like BigBasket's 'Bulk' section, encouraging customers to bring their own containers

- Health-specific purchases: Goli Vada Pav's health-focused outlets, offering nutritious snacks and beverages

These micro-formats allow retailers to tap into specific customer needs, creating a more personalized shopping experience. As customers, you're driving this change with your preferences, pushing retailers to innovate and adapt. The future of retail is all about relevance and convenience – and stores are evolving to deliver just that.

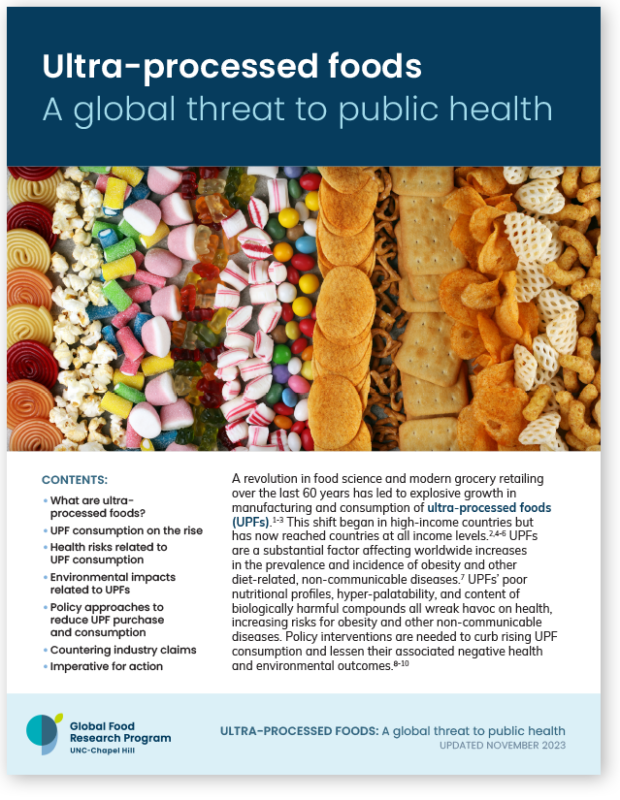

Health and Wellness Take Center Stage

You've probably noticed the shift – health and wellness are no longer niche categories, but rather the driving force behind food purchasing decisions. In fact, according to a recent survey, 75% of Indian consumers consider health benefits when choosing a product. It's clear that shoppers expect wellness embedded in every category, with clear labels and health benefits.

Take functional drinks, for example. Brands like HUL's Kwality Walls and Dabur's Real Activ are leading the charge with products that combine taste and nutrition. These drinks aren't just refreshing; they're also packed with vitamins, minerals, and antioxidants that cater to specific health needs. And it's not just about beverages – plant-based hybrids are becoming increasingly popular, with companies like ITC and Nestle introducing plant-based alternatives to traditional favourites.

Retail Therapy

Retailers are taking notice, too. They're planning their assortments, layouts, and promotions around health behavior clusters. For instance, stores are creating dedicated sections for wellness products, making it easier for shoppers to find what they need. You're more likely to spot products like turmeric-infused snacks or probiotic-rich yogurts in these sections.

- Clear labeling and health claims are key – look for products with certifications like 'low-fat' or 'high-fiber'

- Functional ingredients like ashwagandha and ginger are gaining traction

- Personalized nutrition is the future – expect more products tailored to specific dietary needs

As a shopper, you're likely seeking products that align with your wellness goals. And with the industry responding with innovative products and retail strategies, you're in luck!

Personalized Pricing and Marketing

You've probably noticed how often you get tailored offers on your loyalty apps or digital wallets - that's personalized pricing in action. Companies like Swiggy and Zomato are leveraging this, sending you deals on your favorite foods based on your order history. It's a win-win: you save money, and they boost sales.

Real-Time Adjustments with AI

AI systems are taking it up a notch, adjusting promotions in real-time to maximize impact. For instance, Domino's Pizza saw a 15% increase in sales after implementing AI-driven personalized offers. These systems consider your order frequency, basket size, and even the time of day you usually order. The goal? To make you more likely to come back and order again.

Mass discounting is giving way to personalized pricing strategies. Why? Because targeted deals build loyalty and drive sales more effectively. Starbucks, for example, uses its loyalty app to offer personalized rewards, resulting in a significant boost in customer retention.

- Loyalty apps enable hyper-targeted offers at scale

- AI adjusts promotions in real-time to boost sales and retention

- Personalized pricing is replacing mass discounting

The shift is clear: personalized pricing and marketing are reshaping the food industry, making customer experience more tailored and engaging. As you navigate this new landscape, expect more deals that feel made just for you.

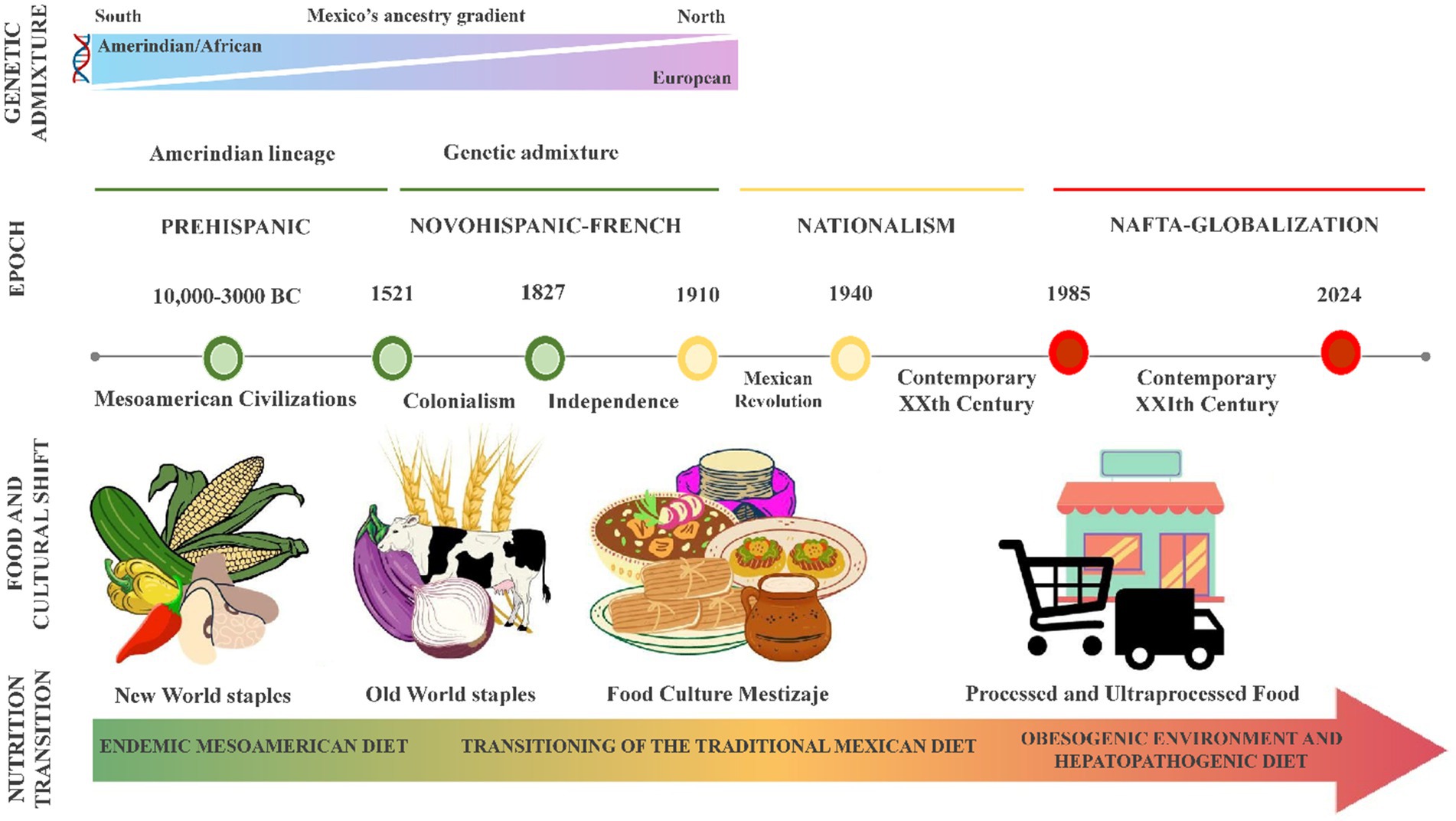

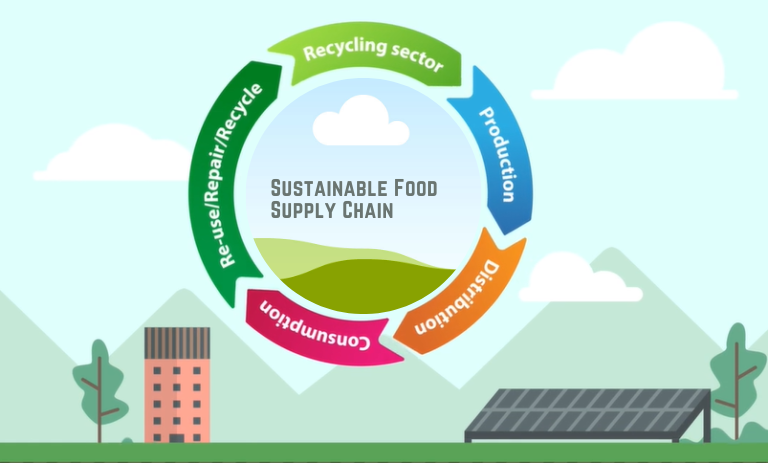

Sustainability Drives Operational Change

As environmental concerns continue to mount, the food industry is shifting from just talking the talk to walking the walk. You're seeing a significant move from sustainability being a brand narrative to it becoming a compliance and cost issue. Governments are setting stricter regulations, and consumers are demanding more eco-friendly options.

Grocers are investing heavily in tools that help track waste, manage markdowns, and optimize packaging. For instance, Tesco's food waste reduction program has helped the company reduce waste by 40% since 2016. Similarly, Walmart's sustainability index has helped the retailer reduce greenhouse gas emissions from its operations by 20% since 2015.

Supply chains are also undergoing a significant transformation, with a focus on transparency, ethical sourcing, and circular material usage. Companies like Unilever and Nestle are working to source 100% of their agricultural raw materials sustainably. Meanwhile, startups like Full Harvest are using AI to reduce food waste by connecting farmers with buyers for imperfect produce.

As you can see, sustainability is no longer just a buzzword; it's a business imperative. Companies that fail to adapt risk facing significant reputational and financial consequences. On the other hand, those that lead the charge will reap the rewards of increased customer loyalty, reduced costs, and a more resilient supply chain.

Future-Proofing the Grocery Industry

The grocery industry's landscape is shifting rapidly, and staying ahead of the curve requires adaptability and innovation. Local sourcing and agile supply chains are becoming make-or-break factors for retailers. By partnering with local farmers and producers, grocers can ensure fresher products, reduce carbon footprints, and support community economies. Take, for instance, the success of companies like Morrisons in the UK, which has committed to sourcing over 90% of its fresh produce locally.

Embracing Smart Automation

Automation is no longer a luxury, it's a necessity. Digital shelf labels, AI-powered queue monitoring, and automated inventory management are just a few examples of technologies transforming the grocery sector. These innovations not only boost productivity but also enhance customer experience. For example, Walmart's use of AI-driven shelf scanning technology has reduced out-of-stock instances by 30%.

Grocery shopping habits have permanently shifted, with consumers prioritizing convenience, health, and value. You need to respond to these changes by reimagining store layouts, optimizing online platforms, and offering personalized promotions. Consider the rise of dark stores – warehouses dedicated to fulfilling online orders – which have become a vital component of many retailers' strategies.

- Invest in data analytics to understand shopper behavior and preferences

- Develop omnichannel experiences that blend online and offline shopping

- Foster partnerships with local suppliers and producers

The future of grocery retail belongs to those who can adapt, innovate, and respond to changing consumer needs. As Amazon's Jeff Bezos once said, "What's always going to be true is that people are going to want lower prices and faster delivery – and that's not going to change."

:max_bytes(150000):strip_icc()/dog-treats-glass-storage-container-3f5d7e36-81df4011d844459c9272c9c8404bc38d.jpg)

Comments ()