AI Stock Market Crash - Trillions at Risk

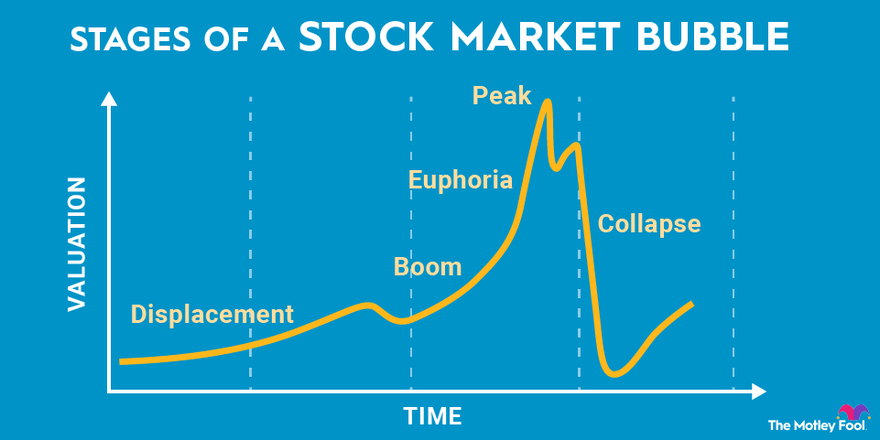

The AI bubble is looming large, and experts warn it could be 17 times the size of the dot-com crisis, putting trillions of dollars at risk. With 95% of AI pilots crashing and companies set to spend a staggering $1.4 trillion on data centers by 2027, the writing's on the wall. The Magnificent Seven - Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla - control 37% of the S&P 500, making them a ticking time bomb. If they crash, every index fund and retirement account goes down with them. As billionaire Ken Griffin warns, we're echoing the dot-com bubble, and the consequences could be catastrophic. But what's fueling this AI frenzy, and can it be stopped?

The Looming Threat

You're probably feeling the heat - the AI stock market bubble is getting ready to burst. Experts are warning of a potential 40% crash, and it's not just a minor correction. We're talking trillions of dollars at risk. The numbers are staggering: Nvidia's market value plummeted by $279 billion in a single day, while Microsoft and Apple are also seeing significant losses. The signs are there, and investors are bracing for impact. Some are predicting a short-lived but sharp correction, while others are warning of a more prolonged downturn. The truth is, nobody knows exactly what's going to happen, but one thing is certain - the AI market is due for a reality check. The valuations are getting out of hand, with some AI stocks trading at nosebleed levels. The fear is that when the bubble bursts, it'll take a chunk of the broader market with it. According to Bank of America, the AI market is expected to take a hit, with some stocks potentially losing up to 40% of their value.

The warning signs are flashing red. Experts like Elon Musk are cautioning about the dangers of unchecked AI development, while others are pointing to the lack of profitability in many AI startups. You're right to wonder if the AI market is overheating. After all, the sector has seen explosive growth in recent years, with the likes of Nvidia and Microsoft leading the charge.

What's at Stake?

The potential consequences of an AI stock market crash are severe. A correction could wipe out trillions of dollars in wealth, affecting not just investors but also the broader economy. With the market's volatility showing no signs of slowing down, it's essential to stay informed and be prepared for the worst.

Dive deeper: What are the main drivers of the AI stock market? How can investors protect themselves from a potential AI market crash? What impact would an AI stock market crash have on the broader economy?

The Rise of AI Mania

You've probably noticed the AI frenzy in the stock market. Companies like Nvidia and Meta Platforms have been on a tear, with their stocks soaring to new heights. Nvidia, for instance, has seen its stock price surge over 200% in the past year alone, thanks to its dominance in AI chips.

So what's driving this AI gold rush? It's largely investor enthusiasm. Billions have poured into AI-focused companies, pushing valuations to stratospheric levels. Meta Platforms, Alphabet, and Microsoft are just a few examples of tech giants going all-in on AI, with investors betting big on their potential.

The Numbers Are Stunning

Consider this: the AI market is projected to hit $190 billion by 2025, growing at a staggering 40% CAGR. With such tantalizing prospects, it's no wonder investors are going guesstimate mode, piling into AI stocks in hopes of future wins. The thing is, this rapid growth and hype have pushed many AI stocks into overbought territory.

- Nvidia's price-to-earnings ratio is over 70, indicating high expectations

- AI-focused funds have seen inflows of over $10 billion in the past quarter

- Many AI companies are trading at significant premiums to their tech peers

The upshot? The AI sector is becoming increasingly vulnerable to a correction. When hype meets reality, volatility often follows. If AI growth doesn't meet lofty expectations, there's a risk of a sharp downturn. That's the risk investors are facing in this frenetic AI market.

Warning Signs Flashing Red

You've probably heard the saying "when the experts are worried, you should be too." Mark Mobius, a veteran investor and founder of Mobius Capital Partners, is sounding the alarm on AI stocks. He's predicting a whopping 40% crash in the market, and given his track record, it's worth paying attention to.

The signs are everywhere – companies are throwing billions at AI infrastructure and data centers, reminiscent of the dot-com era. Nvidia, a key player in the AI chip market, has seen its stock price skyrocket, but its price-to-earnings ratio is getting stretched. You're talking about a company that's valued at over $1 trillion, with a P/E ratio that's higher than many of its tech peers.

The Bubble's Getting Bigger

The AI stock market is starting to look like a classic bubble. Companies like Alphabet, Amazon, and Microsoft are investing heavily in AI, but the returns aren't quite there yet. It's like they're in an arms race, afraid to pull back lest they fall behind. This kind of spending is unsustainable, and investors are getting nervous.

- AI companies are burning cash at an alarming rate

- Valuations are detached from reality

- Market volatility is increasing

You're seeing this nervousness play out in the market. Some investors are taking profits, while others are holding on, hoping the AI hype train keeps rolling. But the thing about bubbles is they're unpredictable – they can pop at any moment. Just ask anyone who was invested in Theranos or WeWork.

The question on everyone's mind is: when will the AI bubble burst? Mobius thinks it's sooner rather than later. Whether he's right or wrong, one thing's for sure – caution is warranted. If you're invested in AI stocks, it's time to take a closer look at your portfolio and consider hedging your bets.

The Big Losers

The AI stock market crash is hitting some major players hard, and you're probably wondering who's taking the biggest hit. Nvidia's been getting hammered, losing a whopping $459 billion in market value. That's not a typo - it's a massive drop, and it's sending shockwaves through the tech industry.

The Casualties

Meta Platforms is another big-name casualty, shedding $302 billion in value. And it's not just these two - Microsoft, Broadcom, and Tesla are all seeing significant losses. These companies are household names, and their struggles are making investors nervous.

So what's behind this sudden downturn? For one, investors are getting spooked about AI's lofty valuations. Remember how everyone's been piling into AI stocks, betting big on the next big thing? Well, some folks are getting nervous that the returns might not materialize as quickly as they hoped. And when investors get nervous, they start selling - and fast.

- Nvidia: $459 billion lost in market value

- Meta Platforms: $302 billion shed

- Microsoft, Broadcom, Tesla: significant losses underway

The AI boom was looking unstoppable, but now the tables are turning. Are we seeing a correction or a full-blown crash? Only time will tell, but one thing's for sure - the market's getting jittery.

Emerging Markets to the Rescue?

You might be wondering where the next big opportunity lies if AI stocks correct. According to Mobius, emerging markets are the place to be. The veteran investor sees countries like China and India driving growth, thanks to their rapidly expanding economies and growing middle class.

Growth Story Unfolds

China's economy is expected to grow at a respectable 4.5% in 2024, while India's is forecasted to hit 6.5%. Compare that to the US, which is projected to grow at a more modest 2.1%, and you start to see why emerging markets are looking attractive. Add potential US Federal Reserve rate cuts to the mix, and you've got a perfect storm for emerging markets to shine.

Mark Mobius, the legendary investor, has been vocal about his bullish stance on emerging markets. He points to countries like Indonesia, Mexico, and Vietnam as having strong growth prospects. "The combination of lower valuations and higher growth potential makes emerging markets very attractive," he says.

- China's middle class is expected to reach 1.2 billion by 2025

- India's digital economy is projected to hit $1 trillion by 2025

- Emerging markets account for 60% of global GDP growth

If AI stocks do correct, investors may shift focus to emerging markets, driving growth and returns. It's not a zero-sum game, but rather a shifting landscape where opportunities arise when you least expect them.

Navigating the Storm

The AI stock market is like a high-speed train, and right now, it's barreling down the tracks at full speed. But with great speed comes great risk. You're probably wondering what's next – will it derail, or will it keep hurtling forward? Here's the thing: investors should be prepared for a pullback. It's not a matter of if, but when.

Take the dot-com bubble, for example. In 2000, tech stocks plummeted, leaving many investors with massive losses. But for those who were prepared, it was a buying opportunity. Companies like Amazon and Google emerged stronger than ever, rewarding long-term investors who had the courage to invest during the downturn. A correction in the AI sector could provide a similar opportunity. Think about it – companies like Nvidia, Microsoft, and Alphabet are leading the charge in AI, and their stock prices have skyrocketed. But if there's a pullback, it could be a chance to get in on the ground floor.

Diversification is Key

In uncertain times like these, diversification is crucial. You don't want to put all your eggs in one basket, right? Spread your investments across different sectors – tech, healthcare, finance – to minimize risk. And don't forget to keep some cash on hand, too. Cash is king, as the saying goes.

- Consider hedging your bets with stable, dividend-paying stocks

- Keep an eye on emerging trends like quantum computing and biotechnology

- Stay informed, but avoid knee-jerk reactions

The AI revolution is still in its early stages, and there's likely to be significant growth ahead. But volatility is part of the game. By being prepared and staying informed, you can navigate the storm and potentially come out on top.

Rising from the Ashes

The AI stock market crash might feel like the end of the world, but it's actually a chance for savvy investors to regroup and refocus. A correction can be a great opportunity to reassess your portfolio and rebalance your investments. It's a time to take a step back and ask yourself if your current holdings are aligned with your long-term goals.

While the AI sector takes a hit, other markets are waiting in the wings. Emerging markets, for instance, could offer some hidden gems. Countries like India and Vietnam are investing heavily in AI infrastructure, making them attractive bets for the future. And let's not forget about sectors like healthcare and finance, which are ripe for AI disruption. Companies like Infosys and HDFC Bank are already leveraging AI to drive growth.

What's Next for AI?

The AI sector will likely rebound, but it'll be a more nuanced recovery. Investors will be looking for companies with solid profitability and growth prospects. It's not just about being the biggest or the most hyped; it's about being the best. Expect to see a shift towards more practical AI applications, like natural language processing and computer vision, which are already showing promise in industries like retail and manufacturing.

- Look for companies with strong cash flows and low debt

- Focus on AI applications with real-world impact

- Keep an eye on emerging markets and sectors

The AI landscape is evolving, and those who adapt will thrive. As Warren Buffett says, "Be fearful when others are greedy, and greedy when others are fearful." There's opportunity in the ashes – you just need to know where to look.

Comments ()