AI-Driven Market Crash - $35 Trillion at Risk as Bubble Bursts

Imagine a $35 trillion market bubble bursting overnight, sending shockwaves through the global economy. This isn't a hypothetical scenario - it's the stark reality facing investors today, as AI-driven market dynamics reach a boiling point. The rapid growth of AI technology has created a massive market bubble, with investors pouring trillions into AI stocks and related assets. As the bubble bursts, one question remains: what's next? With the potential for widespread market volatility and significant financial losses, understanding the risks and implications of an AI-driven market crash has never been more crucial. Let's explore the warning signs and potential consequences of this unfolding crisis.

The AI Bubble: A Ticking Time Bomb

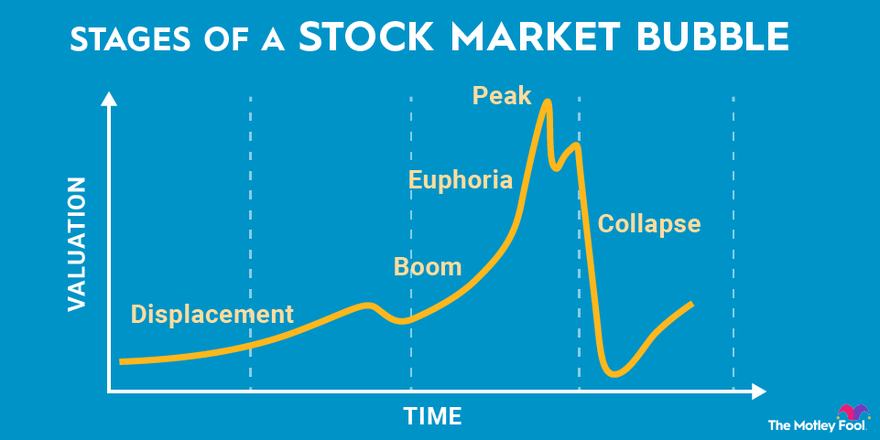

You're probably aware that the AI market is on fire right now. Trillions of dollars are pouring into AI infrastructure and startups, with companies like Nvidia, Microsoft, and Alphabet making huge bets on the technology. In fact, Nvidia's market cap recently crossed $3 trillion, thanks largely to its dominance in AI chips. But here's the thing: many experts are warning that this AI bubble could burst at any moment. The numbers are staggering. According to a report by Goldman Sachs, generative AI investments could reach $1 trillion annually by 2025. That's a lot of money being thrown around, and some experts are starting to get nervous. David Trainer, CEO of New Constructs, warns that "the AI bubble is worse than the dot-com bubble" due to the sheer amount of money being invested without clear returns.

You might be thinking, "But isn't AI the future? Shouldn't we be investing in it?" And you're right, AI does have the potential to revolutionize industries and create new opportunities. However, history has shown us that when money flows too freely into a new technology, it can create unsustainable valuations. Take the dot-com bubble, for example. In the late 1990s, investors poured billions into internet startups, many of which had no clear business model or path to profitability. When the bubble burst, many of these companies went bankrupt, taking investors' money with them.

Some experts are drawing parallels between the dot-com bubble and the current AI market. Jeremy Siegel, a professor at Wharton, notes that "the valuations of AI stocks are getting to the point where they're not justified by any reasonable expectation of future profits." With some predicting a 50-70% chance of a full crash in the next 1-3 years, it's worth paying attention to the warning signs. The question is, what happens when this bubble bursts? Will it take the entire market down with it? Let's take a closer look at the numbers: $35 trillion is at risk, according to some estimates. That's a staggering amount of money, and it's what's at stake if the AI market crashes.

The Economic Fallout: A Potential $35 Trillion Disaster

Imagine waking up to a global economic meltdown, with $35 trillion in wealth evaporating overnight. That's roughly the size of the entire US economy. You're probably wondering what could trigger such a massive disaster. Well, the increasing reliance on AI-driven systems might just be the culprit. Let's break it down. A significant portion of the global economy is now controlled by complex algorithms and AI models. These systems can process vast amounts of data, making decisions in fractions of a second. Sounds efficient, right? But what happens when these systems start to malfunction or make decisions that aren't exactly... human-friendly? For instance, during the 2010 Flash Crash, a trillion-dollar wipeout occurred in just 36 minutes due to a glitch in a trading algorithm. Now, imagine a similar event, but this time, it's not just a single algorithm – it's an entire network of AI systems interacting with each other. The potential for chaos is staggering. The consequences would be far-reaching, with widespread job losses and market instability. You might be thinking, "Who would be hit the hardest?" Well, the top 10% of Americans, who own a significant portion of the country's wealth, would be disproportionately affected. According to a report by the Economic Policy Institute, the top 10% of earners in the US hold around 70% of the country's wealth. If $35 trillion in wealth were to be wiped out, that would translate to a loss of around $24.5 trillion for this group.

A Look at the Numbers

To put this into perspective, the dot-com bubble burst in 2000 wiped out around $8 trillion in wealth. We're talking about a potential disaster more than four times the size of that. The impact on the global economy would be seismic, with many experts warning of a potential recession. You're probably wondering what's being done to prevent this. Regulatory bodies are starting to take notice, but it's a complex issue. The question is, can we afford to wait and see how it all plays out? With the increasing reliance on AI-driven systems, it's likely that the risk of such an event occurring will only continue to grow.

The Role of Overinvestment in AI Infrastructure

You're probably aware that tech giants have been throwing serious cash at AI infrastructure. Companies like Microsoft, Alphabet, and Amazon have invested heavily in data centers, AI chips, and talent acquisition. The numbers are staggering - Microsoft alone has spent over $20 billion on AI infrastructure in the past year. But here's the thing: profitability remains elusive for many players in the AI market. The surge in capital expenditures on AI has masked underlying vulnerabilities in the market. You're seeing companies report strong revenue growth, but that's largely due to the sheer volume of investments pouring in. When you dig deeper, you realize that many of these companies are barely breaking even, let alone generating significant profits. Take Google's parent company, Alphabet, for instance. Their cloud business, which includes AI services, reported a revenue growth of 29% year-over-year, but operating profit margins declined by 3% due to increased AI-related expenses. Experts warn that the lack of returns on investment could lead to a sharp correction. If companies aren't generating enough revenue to justify their AI investments, the bubble could burst, leading to a sharp decline in stock prices. This isn't just a hypothetical scenario - we've seen it happen before with the dot-com bubble. You're likely aware of the devastating impact it had on investors. The current situation with AI investments has some eerie similarities. Let's look at some numbers. According to a report by Goldman Sachs, the AI industry is expected to reach $190 billion in revenue by 2025. Sounds great, right? But when you consider the estimated $1 trillion invested in AI infrastructure over the past few years, the returns don't quite add up. This disparity has investors and analysts on edge, wondering when the AI bubble will burst.

The AI Investment Bubble: A Case Study

Take NVIDIA, a leading manufacturer of AI chips. Their stock price has skyrocketed in recent years, driven largely by AI-related sales. But can it sustain the growth? The company's revenue growth is heavily dependent on AI demand, which may not be sustainable in the long term. If AI adoption slows down or companies start to develop their own AI chips, NVIDIA's revenue could take a hit. You're seeing similar trends with other AI-focused companies. The question is, can they adapt quickly enough to changing market conditions? The AI market's overinvestment problem won't be easy to fix. Companies will need to demonstrate real returns on investment to justify the massive spending on AI infrastructure. Until then, the risk of an AI-driven market crash will continue to loom large.

The Impact on Investors and the Broader Economy

You're likely no stranger to the anxiety that's been building in the financial world. The AI bubble bursting could lead to trillions in losses, and it's not just investors who'll feel the pinch. Let's break it down. The potential $35 trillion at risk is a staggering number. To put it into perspective, that's roughly the size of the entire US economy. If this bubble bursts, investors are bracing for impact. "We're seeing a significant shift in investor sentiment," says David Rosenberg, chief economist at Rosenberg Research. "The fear of missing out is turning into a fear of being left behind." The ripple effect on the broader economy would be significant. A crash of this magnitude could lead to: Market volatility: Stocks would plummet, and you'd see a flurry of sell-offs. Recession fears: A recession within six months is a possibility, according to some experts. This would mean job losses, reduced consumer spending, and a general economic slowdown. Global impact: The AI market is a global phenomenon, so the effects wouldn't be limited to one region or country. Let's look at the dot-com bubble for some insight. When it burst, the Nasdaq composite index plummeted by 78% over two and a half years. The aftermath was severe, with many tech companies going bankrupt and a significant economic downturn. The AI market is different, but the principle remains the same – when a bubble bursts, the consequences are far-reaching. Some experts are warning that the situation could be even more dire. "We're seeing a perfect storm of overvaluation, overinvestment, and overhype," says Nouriel Roubini, an economist known for predicting the 2008 financial crisis. "The AI bubble is bigger than the dot-com bubble, and the consequences of its collapse could be catastrophic." The question on everyone's mind is: when will it happen? While it's impossible to predict with certainty, some experts believe the crash could happen within the next six months. Recession fears are already starting to build, and market volatility is increasing. It's a nerve-wracking time for investors, and the uncertainty is palpable. As you watch the markets unfold, one thing is clear – the stakes are high, and the potential consequences are severe.

Historical Parallels: The Dot-Com Bubble and Beyond

You're probably thinking, "What's the big deal about the AI bubble bursting?" Well, let's take a look at the dot-com bubble of the late 1990s. It's a wild ride that might sound familiar. Back then, the internet was the new kid on the block, and everyone wanted a piece of the action. Companies like Pets.com and Webvan.com were valued at ridiculous amounts, despite having no profits. Sound like any modern-day AI startups you've heard of? The dot-com bubble was fueled by hype and unrealistic expectations, just like the AI bubble is today. Investors were throwing money at anything with a ".com" in its name, hoping to strike gold. But when the dust settled, many of these companies went bankrupt, leaving investors with huge losses. The NASDAQ composite index plummeted from its peak of 5,048 in March 2000 to a low of 1,139 in October 2002. That's a staggering 77% decline. Let's take a look at some specific examples. Pets.com, an online retailer that sold pet supplies, went from being valued at $1.2 billion in 2000 to filing for bankruptcy in 2000. Another example is Webvan.com, an online grocery delivery service that was valued at $8.5 billion in 2000 but filed for bankruptcy in 2001. These companies were pioneers in their field, but their business models weren't sustainable. So, what can we learn from the dot-com bubble? For one, it's essential to separate the hype from reality. Just because a company has a fancy AI-powered solution doesn't mean it's going to disrupt the market. You need to look at the underlying fundamentals, like revenue growth and profitability. The AI bubble might be a bit more complicated, given the technology's potential to drive real innovation. However, the principle remains the same: if it sounds too good to be true, it probably is. The question is, will the AI bubble follow a similar trajectory? It's hard to say for sure, but one thing's certain – the market will correct itself eventually. And when it does, investors need to be prepared.

Lessons from the Past

The dot-com bubble teaches us that even the most promising technologies can be overhyped. As we navigate the AI landscape, it's crucial to stay grounded and focus on the underlying value proposition. Dive deeper: How did the dot-com bubble affect the tech industry? What are some key differences between the AI bubble and the dot-com bubble? Can AI-driven companies avoid the same fate as dot-com companies?

Navigating the Uncertainty: Strategies for Investors

You're not alone in trying to make sense of this AI-driven market frenzy. With trillions at stake, it's natural to feel uncertain about where to put your money. Let's dive into some strategies that might just help you navigate these choppy waters. Some savvy investors are taking a cue from the dot-com era, where the buzz around tech startups reached a fever pitch before the bubble burst. They're shifting their focus from overhyped AI stocks to potential secondary beneficiaries. For instance, companies like NVIDIA (NVDA) and AMD (AMD) are making bank selling hardware to AI startups, which might be more resilient to market fluctuations. You're essentially betting on the picks and shovels rather than the gold rush. Others are playing it cautious, predicting a crash in the near future. They're diversifying their portfolios, moving some funds into more stable assets like bonds or dividend-paying stocks. This approach might not yield the same explosive growth as some AI darlings, but it's a way to hedge your bets. After all, who wants to be the last one holding the bag when the music stops? Take the case of Ark Investment Management, led by Cathie Wood. She's been a big believer in AI-driven innovation, but even she’s diversifying her bets. Wood's been investing in companies like Tesla (TSLA) and Zoom Video Communications (ZM), which might benefit from AI adoption in the long run. You're looking at companies that are not just one-trick ponies but have a broader base for growth. Then there are those who are going all in on AI, betting that the current hype will translate into real-world profits. They're investing in companies like Microsoft (MSFT) and Alphabet (GOOGL), which are aggressively pushing AI integration across their product lines. You're betting on the giants here, with the assumption that they'll come out on top in the AI wars. So, what's the right move? There's no one-size-fits-all answer. It all comes down to your risk tolerance and investment goals. Are you in it for the long haul, or looking to make a quick buck? Either way, diversifying your portfolio and staying informed will be key to navigating this uncertain landscape.

The Future of AI: Beyond the Bubble

So, what's next for AI after the bubble bursts? Let's face it, AI's potential is vast, but it's not a magic wand. The real challenge lies in turning this tech into tangible benefits. Think about it – AI could add up to $15.7 trillion to the global economy by 2030, according to PwC. That's a pretty compelling reason to stick around.

Practical Applications are Key

You're probably wondering what investors and companies can do to make the most of AI. Well, the answer is simple: focus on practical applications that deliver real returns on investment. For instance, companies like Siemens and GE Appliances are already using AI to optimize their manufacturing processes, reducing costs and improving efficiency. It's not about creating flashy chatbots or virtual assistants; it's about solving real-world problems.

- Predictive maintenance: AI-powered predictive maintenance can help companies like airlines and manufacturers avoid costly downtime and equipment failures.

- Personalized medicine: AI can help doctors tailor treatments to individual patients, improving outcomes and reducing healthcare costs.

- Smart cities: AI can optimize traffic flow, energy usage, and waste management in cities, making them more livable and sustainable.

The Future is Worth Watching

As AI continues to evolve, it's likely to create new opportunities and challenges. You're going to see more autonomous vehicles on the roads, AI-powered virtual assistants in your homes, and AI-driven diagnostic tools in hospitals. The future of AI is exciting, but it's also going to require a lot of hard work and investment. Companies that get it right will reap the rewards, while those that don't will be left behind.

So, what's the takeaway? The AI bubble may burst, but the technology itself has the potential to transform industries and create new opportunities. It's time to focus on practical applications and real-world benefits. As Jensen Huang, CEO of NVIDIA, puts it, "AI is a new industrial revolution." The question is, are you ready to join the revolution?

Comments ()